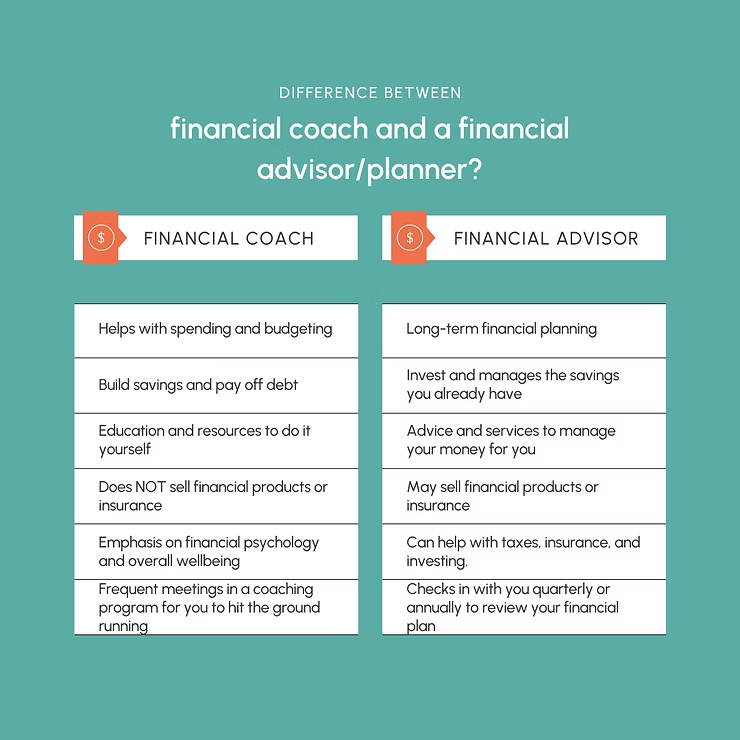

What is the difference between a financial coach and a financial advisor/planner?

You are looking for financial advice, but you don’t know where to start. There are a lot of options out there for getting help with your finances so we are going to break down the two best professionals for getting your financial questions answered and they are the Financial Coach and the Financial Advisor.

What is a financial coach and what do they do?

A financial coach is like a personal trainer for your money and can be considered the first stop on your personal finance evolution.

A coach helps you with your budget, helps you spend with purpose, improve your credit, strategically leverage or pay down debt, increase income, save for goals, provide college/career planning, and overall helps educate on smart daily money management.

A financial coach can also help you understand how your personality, family, culture, and society will affect your financial decisions.

What does a financial coach NOT help with?

Every financial coach’s capabilities and structure are a little different, but here at Evolving Money, a financial coach does not invest your money, tell you what stocks to pick, and will not sell you financial products or insurance. A financial coach at Evolving Money will only provide the education you need to make the decisions that fit you, your family, and your goals.

Your Personal Fitness Trainer can’t lift the weights for you, just like your financial coach won’t spend your money for you. Your coach will help you create the habits you need to be awesome with money and keep you accountable to achieving the goals you set.

Who can be a financial coach?

There is not a single qualification for financial coaches as this is still a new and blooming profession. Really, anyone can call themselves a financial coach. They may have some form of education in the field, or they may have just been on their own personal finance journey and want to share what they learned with you.

However, there is one designation that can help you with your search and that is the Accredited Financial Counselor® which is one of the highest standards in the field of financial counseling, coaching, and education. An AFC® professional has passed an exam testing competency in financial topics and has 1000 hours of experience.

You will have to do some research into what qualification you would want in a financial coach. Do you want someone with a certification and education? Maybe someone who has been on the same journey as you and can relate to your situation? Do you want someone that is an expert on a specific financial topic? Start by answering these questions when looking for a financial coach. You want to find someone that you can trust and enjoy spending time with them.

How do you know if you should work with a financial coach?

If you relate to any of these situations or have any of these goals, you may want to consider working with a financial coach:

- You do not know where all of your money goes every month

- You want to save money but there never seems to be enough

- You are living paycheck-to-paycheck and want to do more with your money

- You have a hard time communicating with your partner about money

- You have debt that is causing you stress and you want to pay down

- You want to stop stressing so much about money

- You want to start that business or side-hustle to bring in more money

- You want to learn the in’s and out’s of personal finance to manage your money on your own

What is a financial advisor (or planner)?

A financial advisor is someone who can help you invest your money in a way that aligns with your risk tolerance, goals, and investing time-frame. In order to do this, they will need a clear understanding of all of your goals and they will use awesome planning software and tools to help you predict your financial success and how to improve the probability of achieving long-term success.

Financial advisors specialize in helping you grow your wealth once you have a certain amount of money to invest and manage. Most advisors will require you to have a minimum amount of assets in order to work with them. Although, there are plenty of advisors that don’t have these minimums.

Your financial advisor will take more of a done-for-you approach. They help you create a holistic financial plan and invest your money to prepare you for retirement and your other goals. They will also help you with tax planning, estate planning, insurance, and long-term planning.

What qualifications should a financial advisor have?

There are actually quite a lot of designations that financial advisors can have. Some will indicate a specialty like taxes, divorce planning, or stock options. The designations you search for will be dependent on your specific situation and needs.

One designation that stands out the most in the Financial Advisor industry is the CERTIFIED FINANCIAL PLANNER designation. A CFP® must take a rigorous course and pass a comprehensive exam that tests their ability to apply financial topics to real life situations. They are required to have 2 years of experience in financial planning and follow a code of ethics and standard enforced by the CFP Board. If you need an advisor that helps you in all areas of your financial life, start by seeking out a CFP®

How do you know if you should work with a financial advisor?

If you need more holistic planning and have questions on saving on taxes, managing your investments, advice on insurance, and planning for retirement, then it might be time to begin a relationship with a financial advisor.

If you think you need a financial advisor, read this blog post about how to find the right one for you, or book a free coaching call with me and I will help you find a financial advisor that fits your needs.

The Bottom Line!

Meeting with a financial coach is a great way to find out which financial professional is a good fit for you. When meeting with me, Taylor, in a free coaching session I can give you referrals to the professionals that you need to meet with to continue on your personal financial evolution.